Essay

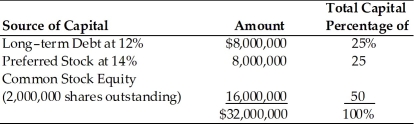

Zheng Sen's Chinese Take-Out had earnings before interest and taxes of $4,000,000 last year. The firm has a marginal tax rate of 40 percent and currently has the following capital structure:  (a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(b) If the firm retires $4,000,000 of preferred stock using the proceeds from an equal increase in long-term debt, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

(c) If the firm retires $4,000,000 of preferred stock using the proceeds from the sale of 500,000 shares of common stock, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

Correct Answer:

Verified

(a)  * $8,000,000 × 0.12 = $960,000

* $8,000,000 × 0.12 = $960,000

** R...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

** R...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: In an efficient market, the expected return

Q51: At year end, Tangshan China Company balance

Q52: Which of the following is a difference

Q53: Identify whether the key characteristic describes common

Q54: According to the efficient market hypothesis, prices

Q56: The Bradshaw Company's most recent dividend was

Q57: Aunt Tilly's Fur Company has been experiencing

Q58: Unlike creditors, equityholders are owners of the

Q59: Ted has 10 shares of Grand Company.

Q60: Stock rights allow stockholders to purchase additional