Essay

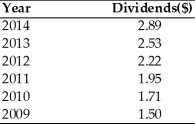

Table 7.1

-The required return is assumed to be 17 percent. Using the Gordon model, calculate the per share value of the stock for 2014. (See Table 7.1)

Correct Answer:

Verified

Per share ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Angel recently purchased a block of 100

Q42: The constant growth model is an approach

Q43: Based on analysis of the company and

Q44: Efficient-market hypothesis is the theory describing the

Q45: Preemptive rights allow common stockholders to maintain

Q47: Jia's Fashions recently paid a $2 annual

Q48: Tangshan China Company's stock is currently selling

Q49: The liquidation value per share of common

Q50: In an efficient market, the expected return

Q51: At year end, Tangshan China Company balance