Essay

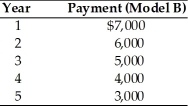

You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well. However, the method of paying for the two models is different. Model A requires $5,000 per year payment for the next five years. Model B requires the following payment schedule. Which model should you buy if your opportunity cost is 8 percent?

Correct Answer:

Verified

Model A: PV = (CF/i)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: The rate of interest actually paid or

Q122: How long would it take for Nico

Q124: Ken borrows $15,000 from a bank at

Q125: Entertainer's Aid plans five annual colossal concerts,

Q126: The effective rate of interest and compounding

Q128: Dorothy borrows $10,000 from the bank. For

Q129: A firm wishes to establish a fund

Q130: Ms. Day needs $20,000 to buy her

Q131: To expand its operation, the International Tools

Q132: Nico makes annual end-of-year payments of $5,043.71