Essay

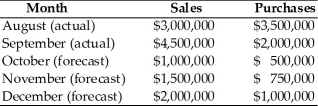

In the preparation of a quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below.  ∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ Interest income of $50,000 on marketable securities will be received in December.

∙ The firm pays cash for 40 percent of its purchases.

∙ The firm pays for 60 percent of its purchases the following month.

∙ Salaries and wages amount to 15 percent of the preceding month's sales.

∙ Sales commissions amount to 2 percent of the preceding month's sales.

∙ Lease payments of $100,000 must be made each month.

∙ A principal and interest payment on an outstanding loan is due in December of $150,000.

∙ The firm pays dividends of $50,000 at the end of the quarter.

∙ Fixed assets costing $600,000 will be purchased in December.

∙ Depreciation expense each month of $45,000.

∙ The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Correct Answer:

Verified

The firm has excess cash duri...

The firm has excess cash duri...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: In preparing a cash budget, the _

Q129: In general, _.<br>A) a longer depreciable life

Q130: Table 4.5<br>A financial manager at General Talc

Q131: In cash budgeting, the impact of depreciation

Q132: A corporation _.<br>A) must use the straight-line

Q134: In April, a firm had an ending

Q135: NICO Corporation had net current assets of

Q136: One way a firm can reduce the

Q137: A firm's net cash flow is the

Q138: The best way to adjust for the