Multiple Choice

Table 4.5

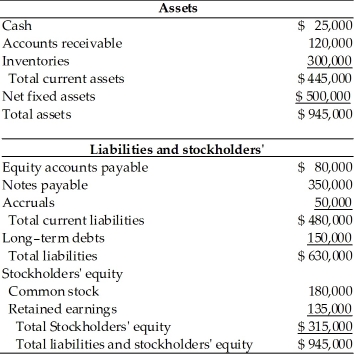

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma current liabilities amount is ________. (See Table 4.5)

A) $400,000

B) $450,000

C) $475,000

D) $500,000

Correct Answer:

Verified

Correct Answer:

Verified

Q150: If the net cash flow is less

Q151: The more seasonal and uncertain a firm's

Q152: The cash flows from financing activities section

Q153: Table 4.3<br>The financial analyst for Sportif, Inc.

Q154: A firm's operating cash flow (OCF) is

Q156: In the month of August, a firm

Q157: Which of the following line items of

Q158: In October, a firm had an ending

Q159: Table 4.5<br>A financial manager at General Talc

Q160: Since the percentage-of-sales method assumes that all