Multiple Choice

Table 4.5

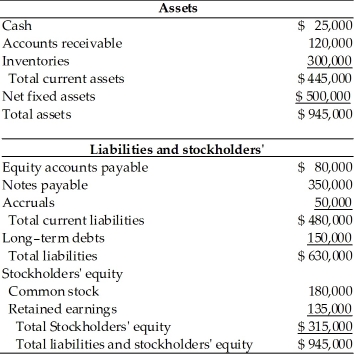

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-General Talc Mines may prepare to ________. (See Table 4.5)

A) arrange for a loan equal to the external funds requirement

B) eliminate the dividend to cover the needed financing

C) cancel the retirement of the long term note to cover the needed financing

D) repurchase common stock equal to the external funds requirement

Correct Answer:

Verified

Correct Answer:

Verified

Q83: Depreciation is considered to be an outflow

Q84: The key input to the short-term financial

Q85: Operating cash flow (OCF) is equal to

Q86: Table 4.8 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 4.8

Q87: Using simulations, a firm can determine the

Q89: Key inputs to short-term financial planning are

Q90: During 2015, NICO Corporation had EBIT of

Q91: Table 4.5<br>A financial manager at General Talc

Q92: Calculate net operating profit after taxes (NOPAT)

Q93: Non-cash charges are expenses that involve an