Essay

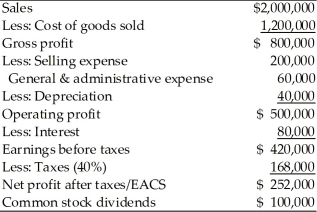

Table 4.6

Income Statement

Ace Manufacturing, Inc.

For the Year Ended December 31, 2015

-Ace Manufacturing, Inc., is preparing pro forma financial statements for 2016. The firm utilized the percent-of-sales method to estimate costs for the next year. Sales in 2015 were $2 million and are expected to increase to $2.4 million in 2016. The firm has a 40 percent tax rate.

(a) Given the 2015 income statement in Table 4.6, estimate net profit and retained earnings for 2016.

(b) If $200,000 of the cost of goods sold and $40,000 of selling expense are fixed costs; and the interest expense and dividends are not expected to change, what is he dollar effect on net income and retained earnings? What is the significance of this effect?

Correct Answer:

Verified

(a)Pro forma income statement: December ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: The statement of cash flows allows the

Q22: The cash flows from operating activities section

Q23: Table 4.3<br>The financial analyst for Sportif, Inc.

Q24: A cash budget gives the financial manager

Q25: Once sales are forecasted, _ must be

Q27: A weakness of the percent-of-sales method of

Q28: If transportation costs were a huge portion

Q29: Operating cash flow (OCF) is calculated by

Q30: Business firms are permitted to systematically charge

Q31: As the typical cash budget shows cash