Multiple Choice

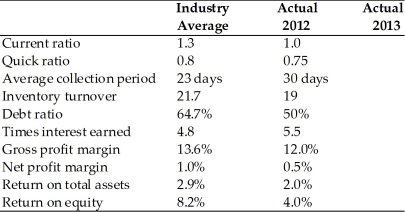

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

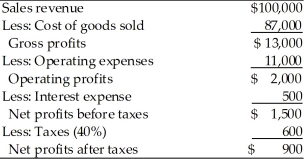

Income Statement

Dana Dairy Products

For the Year Ended December 31, 2013  Balance Sheet

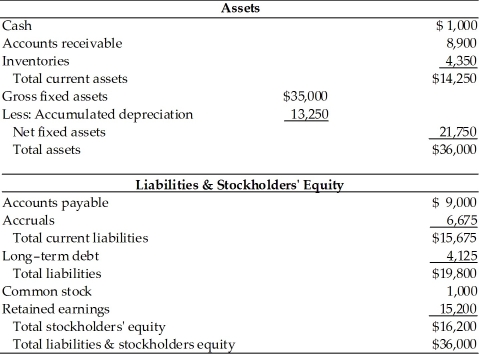

Balance Sheet

Dana Dairy Products

December 31, 2013

-Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier) . Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2013 performance? (See Table 3.2)

A) 5.6(ROE) = 2.5(ROA) × 2.22(Financial leverage multiplier)

B) 5.6(ROE) = 3.3(ROA) × 1.70(Financial leverage multiplier)

C) 4.0(ROE) = 2.5(ROA) × 2.00(Financial leverage multiplier)

D) 2.5(ROE) = 5.6(ROA) × 2.22(Financial leverage multiplier)

Correct Answer:

Verified

Correct Answer:

Verified

Q125: Typically, higher coverage ratios are preferred, but

Q126: Book value per share is the ratio

Q127: Time-series analysis evaluates the performance of various

Q128: Earnings per share represents the dollar amount

Q129: The statement of cash flows reconciles the

Q131: Reliable Auto Parts has 5,000 shares of

Q132: The _ is used by financial managers

Q133: _ may indicate a firm is experiencing

Q134: Table 3.2<br>Dana Dairy Products Key Ratios <img

Q135: Using the DuPont system of analysis, holding