Essay

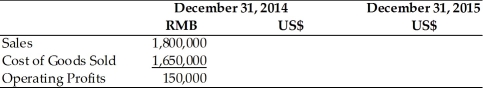

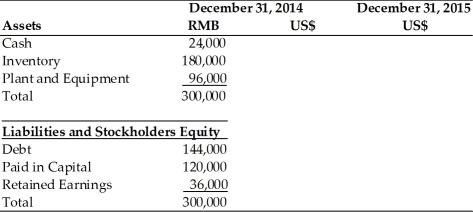

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent.

Translation of Income Statement  Translation of Balance Sheet

Translation of Balance Sheet

Correct Answer:

Verified

This shows that an appreciation of the f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Exchange rate risk hedging tools include forward

Q73: The existence of _ allows multinationals to

Q74: Micro political risk is the risk faced

Q75: A partnership between a multinational company and

Q76: Which of the following is considered to

Q78: Foreign bonds are sold primarily in _.<br>A)

Q79: Which of the following is a positive

Q80: Although several economic and political factors can

Q81: In terms of inventory management, multinational firms

Q82: Between two major currencies, the spot exchange