Essay

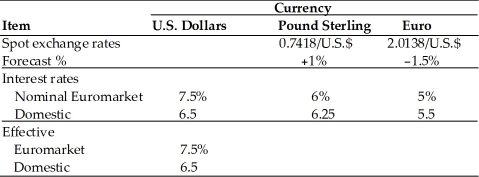

A multinational company has two subsidiaries, one in U.K (local currency, Pound Sterling) and the other in Germany (local currency, Euro). Proforma statements of operations indicate the following short-term financial needs for each subsidiary (in equivalent U.S. dollars): U.K: $25 million excess cash to be invested (lent); Germany: $10 million funds to be raised (borrowed)

The following financial data is also available:  (a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(b) Where should the funds be invested?

(c) Where should the funds be raised?

Correct Answer:

Verified

(a)  (b) $25 million should be...

(b) $25 million should be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: As a foreign exchange hedging tool, options

Q33: Although several economic and political factors can

Q34: If the exchange rate between the U.S.

Q35: Macro political risk and micro political risk

Q36: Fixed relationship among currencies refers to _.<br>A)

Q38: Which of the following is a reason

Q39: The spot exchange rate is the rate

Q40: In 2003-2004, the United States signed a

Q41: The transfer of capital, managerial, and technical

Q42: Economic exposure is the risk resulting from