Multiple Choice

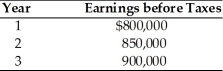

Maxi, Inc. is evaluating the acquisition of Mini, Inc., which had a loss carryforward of $2.75 million which resulted from earlier operations. Maxi can purchase Mini for $3.5 million and liquidate the assets for $1.25 million. Maxi expects earnings before taxes in the three years following the acquisition to be as follows:  (These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is ________.

(These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is ________.

A) $440,374

B) $842,374

C) $1.1 million

D) $2.75 million

Correct Answer:

Verified

Correct Answer:

Verified

Q181: A consolidated corporation has voting control of

Q182: Unlike business bankruptcy and business failure, divestiture

Q183: A congeneric merger is a merger combining

Q184: A key consideration in the holding company

Q185: A _ may result in the expansion

Q186: The combination of two or more companies

Q188: A firm in a merger transaction that

Q189: A _ results from the combination of

Q190: Julie's Tanning Systems has an estimated liquidation

Q191: An attractive candidate for acquisition through leveraged