Multiple Choice

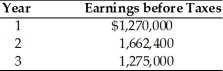

Hayley Medical, Inc. is evaluating the acquisition of Health-o-Matic, Inc., which had a loss carryforward of $3.75 million, resulting from earlier operations. Hayley Medical can purchase Health-o-Matic for $4.5 million and liquidate the assets for $3.25 million. Hayley Medical expects earnings before taxes in the three years following the acquisition to be as follows:  (These earnings are assumed to fall within the annual limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Hayley Medical has a 40 percent tax rate and a cost of capital of 15 percent. The approximate maximum cash price Hayley Medical would be willing to pay for Health-o-Matic is ________.

(These earnings are assumed to fall within the annual limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Hayley Medical has a 40 percent tax rate and a cost of capital of 15 percent. The approximate maximum cash price Hayley Medical would be willing to pay for Health-o-Matic is ________.

A) $4,757,000

B) $4,253,000

C) $4,409,600

D) $3,750,000

Correct Answer:

Verified

Correct Answer:

Verified

Q156: Greater control over the acquisition of raw

Q157: A firm in a merger transaction that

Q158: Leveraged buyouts are clear examples of _.<br>A)

Q159: Which of the following represents an advantage

Q160: The owners of a holding company can

Q162: In defending against a hostile takeover, the

Q163: A formal proposal to purchase a given

Q164: Under recapitalization, debts are generally exchanged for

Q165: A conglomerate merger is a merger combining

Q166: Holding companies are corporations that have voting