Essay

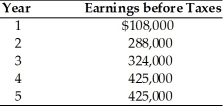

Jia's Oven Manufacturing is evaluating the acquisition of Cuisinaire Kitchen Appliance Co. Cuisinaire has a loss carryforward of $1.5 million which resulted from earlier operations. Jia's Oven can purchase Cuisinaire for $1.8 million and liquidate the assets for $1.3 million. Jia's Oven expects earnings before taxes in the five years following the acquisition to be as follows:  (These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(a) What is the tax advantage of the acquisition each year for Jia's Oven?

(b) What is the maximum cash price Jia's Oven would be willing to pay for Cuisinaire?

(c) Do you recommend the acquisition? Why or why not?

Correct Answer:

Verified

Total tax relief = $1,500,000 × 0.40 = ...

Total tax relief = $1,500,000 × 0.40 = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: A vertical merger may result in expansion

Q83: A merger transaction endorsed by a target

Q84: Firms' motives to merge include growth or

Q85: The value of a firm measured as

Q86: In a voluntary settlement, one group of

Q88: The responsibilities of a debtor in possession

Q89: An important aspect of a firm's reorganization

Q90: Which of the following increases the chances

Q91: When making a cash acquisition of a

Q92: A firm that wants to expand or