Essay

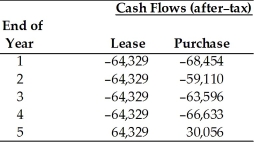

Bessey Aviation is considering leasing or purchasing a small aircraft to transport executives between manufacturing facilities and the main administrative headquarters. The firm is in the 40 percent tax bracket and its after-tax cost of debt is 7 percent. The estimated after-tax cash flows for the lease and purchase alternatives are given below:  (a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(b) Which alternative do you recommend? Why?

Correct Answer:

Verified

(a)  (b) T...

(b) T...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Lisa's Riding Equipment Company has entered into

Q93: The market value of a warrant is

Q94: Purchase options are provisions frequently included in

Q95: A(n) _ lease is a contractual arrangement

Q96: Convertible securities can usually be sold with

Q98: Under FASB Standard No. 13, which of

Q99: Convertible bonds normally have _ to permit

Q100: Preferred stock is considered a hybrid security

Q101: If an investor buys a 100-share call

Q102: A financial lease is often referred as