Multiple Choice

Table 15.1

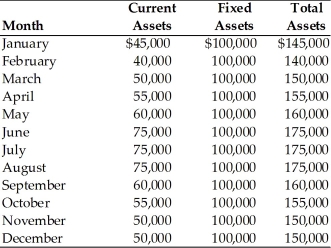

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-The firm's annual financing costs of the aggressive financing strategy are ________. (See Table 15.1)

A) $21,175

B) $26,075

C) $24,475

D) $22,775

Correct Answer:

Verified

Correct Answer:

Verified

Q313: A firm can reduce its cash conversion

Q314: The risk of an investment in a

Q315: An increase in the current liabilities to

Q316: Safety stocks are extra inventories that can

Q317: Table 15.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 15.2

Q319: If a firm's credit period is increased,

Q320: The ability to purchase production inputs on

Q321: The yields on Treasury bills are generally

Q322: _ is a procedure resulting in a

Q323: The goal of working capital management is