Multiple Choice

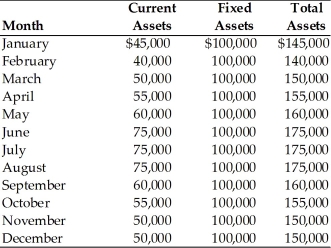

Table 15.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-If the firm's current liabilities in December were $40,000, the net working capital was ________. (See Table 15.1)

A) $140,000

B) $60,000

C) $10,000

D) -$10,000

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Disbursement float is experienced by a payee

Q29: Table 15.7<br>Fizzy Animators, Inc. currently makes all

Q30: Table 15.4<br>Bowring Ball Bearings has 10 different

Q31: Sound cash management techniques would support _.<br>A)

Q32: Ashley's Ad Agency's accounts receivable totaled $451,000

Q34: If a firm's sales are constant, its

Q35: A positive cash conversion cycle means that

Q36: When current assets exceed current liabilities, a

Q37: In the ABC system of inventory management,

Q38: The ACH (automated clearing house) debits are