Multiple Choice

Table 15.1

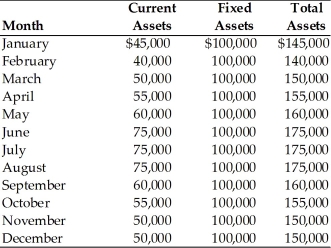

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-The firm's initial ratio of current to total assets is ________. (See Table 15.1)

A) 1:3.2

B) 3:1

C) 2:3

D) 3:2.3

Correct Answer:

Verified

Correct Answer:

Verified

Q37: In the ABC system of inventory management,

Q38: The ACH (automated clearing house) debits are

Q39: In the EOQ model, the total cost

Q40: _ are not obligations of the U.S.

Q41: Under an aggressive funding strategy, a firm

Q43: Which of the following securities is a

Q44: Table 15.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 15.2

Q45: Match each marketable security with its description.<br>(a)

Q46: The General Chemical Company uses 150,000 gallons

Q47: The aggressive funding strategy is risky due