Essay

Table 15.3

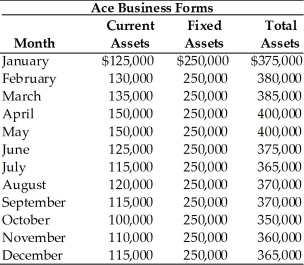

-Ace's Business Forms pays 8 percent on short-term funds and 10 percent on long-term funds. Determine its annual financing costs using the trade-off strategy described: Ace's Business Forms has seasonal financing requirements ranging from zero to $50,000 per month. Based on this range, the firm has decided to finance $25,000 per month of the seasonal funds with long-term debt and the rest of the seasonal funds with short-term debt. The permanent funds requirement will be financed with long-term funds. (See Table 15.3)

Correct Answer:

Verified

Trade-off strategy a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q227: The _ is the time period that

Q228: In an aggressive financing strategy, a firm

Q229: The key dimension of credit selection which

Q230: A firm with highly unpredictable sales revenue

Q231: Float exists when a payee has received

Q233: Float is important in the cash conversion

Q234: Assuming that a firm has done all

Q235: Mail float is the delay between the

Q236: Federal agency issues are obligations of the

Q237: Processing float is the delay between the