Essay

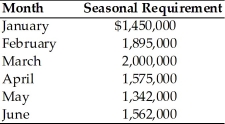

Studio San, a dealer in contemporary art, has forecasted its seasonal financing needs for the next six months as follows:  (a) The firm projects that short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(a) The firm projects that short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(b) The firm's permanent funds requirement is $500,000.

Calculate financing costs for the first six months using the aggressive and conservative strategies.

Correct Answer:

Verified

Average monthly seasonal funds requireme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q277: In the EOQ model, _ costs are

Q278: The reorder point is the point at

Q279: A firm purchased raw materials on account

Q280: An increase in the average payment period

Q281: _ are short-term money market instruments that

Q283: Table 15.7<br>Fizzy Animators, Inc. currently makes all

Q284: A firm has arranged for a lockbox

Q285: Taizhou Products uses 800 units of a

Q286: An increase in current assets increases net

Q287: An increase in accounts receivable turnover due