Essay

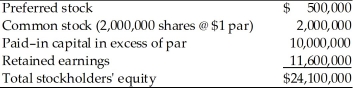

Hayley's Optical has a stockholders' equity account as shown below. The firm's common stock currently sells for $20 per share.  (a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(b) Recast the partial balance sheet (the stockholders' equity accounts) to show independently

(1) a 2-for-1 stock split of the common stock.

(2) a cash dividend of $1.50 per share.

(3) a stock dividend of 5% on the common stock.

(c) At what price would you expect Hayley's Optical stock to sell after

(1) the stock split?

(2) the stock dividend?

Correct Answer:

Verified

(a) The maximum dividend per share the f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: While an earnings requirement limiting the amount

Q101: The market rewards firms that adopt a

Q102: The shareholder receiving a stock dividend receives

Q103: Clientele effect is the argument that a

Q104: Gordon's "bird-in-the-hand" argument suggests that _.<br>A) dividends

Q106: Regularly paying a fixed or increasing dividend

Q107: A constant-payout-ratio dividend policy is based on

Q108: Ignoring general market fluctuations, the stock's price

Q109: Legal capital refers to _.<br>A) a legal

Q110: The dividend payment date is set by