Essay

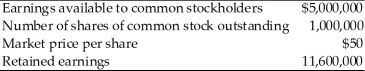

Tangshan Mining Company has released the following information.  (a) What are Tangshan Mining's current earnings per share?

(a) What are Tangshan Mining's current earnings per share?

(b) What is Tangshan Mining's current P/E ratio?

(c) Tangshan Mining wants to use half of its earnings either to pay shareholders dividends or to repurchase shares for inclusion in the firm's employee stock ownership plan. If the firm pays a cash dividend, what will be the dividend per share received by existing shareholders?

(d) Instead of paying the cash dividend, what if the firm uses half of its earnings to pay $55 per share to repurchase the shares, what will be the firm's new EPS? What should be the firm's new share price?

(e) Compare the impact of a stock dividend and stock repurchase on shareholder wealth.

Correct Answer:

Verified

(a) EPS = $5,000,000/1,000,000 = $5.00 p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: The problem with the regular dividend policy

Q61: Tangshan Mining has common stock at par

Q62: With regard to dividend payments, which of

Q63: In a tender offer share repurchase, a

Q64: Under the Jobs and Growth Tax Relief

Q66: Since lenders are generally reluctant to grant

Q67: In case of stock dividend, the shareholder's

Q68: The level of dividends a firm expects

Q69: The clientele effect refers to _.<br>A) the

Q70: Dividend reinvestment plans (DRIPs) enable stockholders to