Multiple Choice

Table 12.2

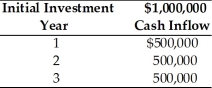

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-The discount rate that should be used in the net present value calculation to compensate for risk is ________. (See Table 12.2)

A) 6 percent

B) 15 percent

C) 18 percent

D) 24 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q30: In case of international capital budgeting, a

Q31: The theoretical basis from which the concept

Q32: In capital budgeting, risk is generally thought

Q33: In capital budgeting, risk is the degree

Q34: The two basic types of risk associated

Q36: Table 12.5<br>Nico Manufacturing is considering investment in

Q37: A market risk-return function is a graphical

Q38: In case of international capital budgeting, long-term

Q39: The difference by which the required discount

Q40: The risk-adjusted discount rate can be computed