Multiple Choice

Table 12.3

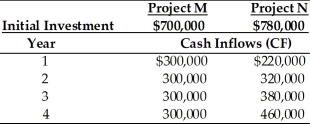

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the better investment for Tangshan Mining is ________. (See Table 12.3)

A) Project M because it has a higher NPV

B) Project N because it has a higher NPV

C) Project N because it has a higher IRR

D) Project M because it has a higher IRR

Correct Answer:

Verified

Correct Answer:

Verified

Q47: In capital budgeting, risk refers to a

Q48: Because a business firm can be viewed

Q49: Table 12.4<br>Johnson Farm Implement is faced with

Q50: Monte Carlo simulation programs usually build a

Q51: In selecting the best group of unequal-lived

Q53: By combining two projects with negatively correlated

Q54: In capital budgeting, risk refers to _.<br>A)

Q55: The shares traded publicly in an efficient

Q56: The risk-adjusted discount rate can be computed

Q57: Exchange rate risk is the risk that