Multiple Choice

Table 12.6

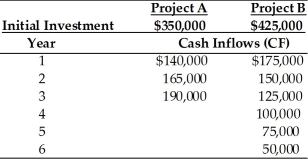

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The annualized NPV of Project A is ________. (See Table 12.6)

A) $22,674

B) $12,947

C) $38,227

D) $21,828

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Political risk is easier to protect as

Q42: A firm with limited funds for investment

Q43: The advantage of using simulation in the

Q44: Projects with a small chance of being

Q45: If a firm has a limited capital

Q47: In capital budgeting, risk refers to a

Q48: Because a business firm can be viewed

Q49: Table 12.4<br>Johnson Farm Implement is faced with

Q50: Monte Carlo simulation programs usually build a

Q51: In selecting the best group of unequal-lived