Multiple Choice

Table 12.6

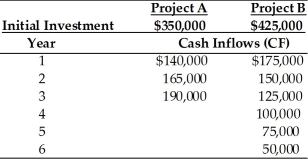

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-Which project should be chosen using the Annualized NPV approach? (See Table 12.6)

A) Project A because its annualized NPV is higher

B) Project B because its NPV is higher

C) Project A because its IRR is higher

D) Project B because its annualized NPV is higher

Correct Answer:

Verified

Correct Answer:

Verified

Q58: Simulation is a statistics-based approach used in

Q59: The higher the risk-adjusted net present, the

Q60: Even though a business firm can be

Q61: Behavioral approaches _.<br>A) are used to explicitly

Q62: One type of simulation program made popular

Q64: Table 12.1<br>A corporation is assessing the risk

Q65: Tangshan Mining Company, with a cost of

Q66: Scenario analysis is a behavioral approach that

Q67: When unequal-lived projects are independent, the impact

Q68: Table 12.3<br>Tangshan Mining Company is considering investment