Multiple Choice

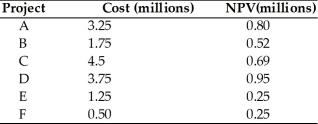

Which of the following proposed projects should be accepted for the upcoming year since only $6 million is available for the next year's capital budget. What is the total NPV of the projects that should be accepted?

A) A, B, & F; total cost = $5.5 million; Total NPV = $1.57

B) F, B, & D; total cost = $6 million; Total NPV = $1.72

C) E, F, & D; total cost = $5.5 million; Total NPV = $1.45

D) A, E, & F; total cost = $5 million; Total NPV = $1.3

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Real options are opportunities that are embedded

Q10: In applying risk-adjusted discount rates to project

Q11: Table 12.2<br>A firm is considering investment in

Q12: Sensitivity analysis is a statistics-based approach used

Q13: The importance and widespread use of transfer

Q15: The risk-adjusted discount rate (RADR) is the

Q16: The break even cash inflow is the

Q17: A preferred approach for risk adjustment of

Q18: In capital budgeting, risk refers to _.<br>A)

Q19: The annualized net present value approach used