Multiple Choice

Table 11.2

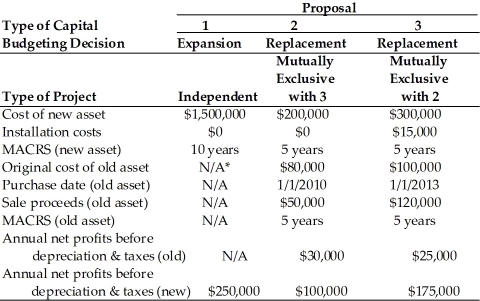

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 1, the depreciation expense for year 1 is ________. (See Table 11.2)

A) $110,400

B) $115,200

C) $150,000

D) $300,000

Correct Answer:

Verified

Correct Answer:

Verified

Q107: Please explain the difference between a sunk

Q108: A corporation is considering expanding operations to

Q109: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q110: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt=" -A corporation is

Q111: Opportunity costs should be included as cash

Q112: A corporation is selling an existing asset

Q114: The portion of an asset's sale price

Q115: A loss on the sale of an

Q116: Table 11.5<br>Nuff Folding Box Company, Inc. is

Q117: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer