Multiple Choice

Table 11.2

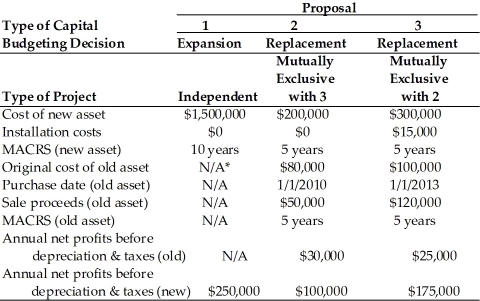

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 2, the cash flow pattern for the replacement project is ________. (See Table 11.2)

A) a mixed stream and conventional

B) a mixed stream and nonconventional

C) a perpetuity and conventional

D) an annuity and nonconventional

Correct Answer:

Verified

Correct Answer:

Verified

Q70: The tax treatment regarding the sale of

Q71: The relevant cash flows for a proposed

Q72: Should financing costs such as the returns

Q73: A corporation is considering expanding operations to

Q74: Incremental cash flows represent the additional cash

Q76: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q77: To calculate the initial investment, we subtract

Q78: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q79: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q80: Table 11.5<br>Nuff Folding Box Company, Inc. is