Multiple Choice

Table 11.2

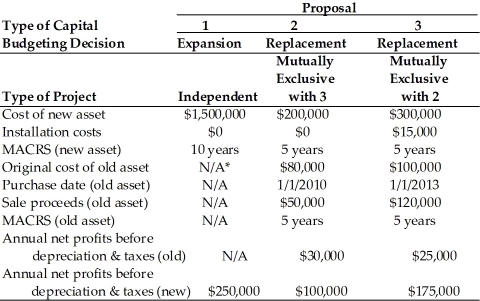

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 2, the tax effect on the sale of the existing asset at the end of the fifth year results in ________. (See Table 11.2)

A) $12,000 tax liability

B) $14,560 tax liability

C) $25,280 tax liability

D) $16,600 tax liability

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Table 11.1<br>Fine Press is considering replacing the

Q54: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q55: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q56: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q57: The three major cash flow components include

Q59: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q60: Table 11.1<br>Fine Press is considering replacing the

Q61: If an asset is depreciable and used

Q62: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q63: The tax treatment regarding the sale of