Essay

Table 11.4

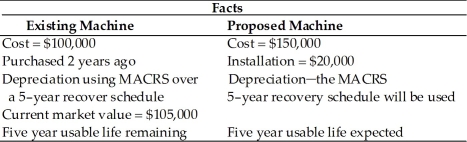

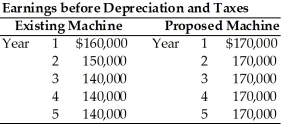

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

-Calculate the initial investment required for the new asset. (See Table 11.4)

Correct Answer:

Verified

Correct Answer:

Verified

Q91: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q92: Table 11.5<br>Nuff Folding Box Company, Inc. is

Q93: Under MACRS depreciation, the depreciable value of

Q94: The basic cash flows that must be

Q95: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt=" -Which of the

Q98: Relevant cash flows for a project are

Q99: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q100: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q101: Table 11.2<br>Computer Disk Duplicators, Inc. has been