Essay

Table 11.4

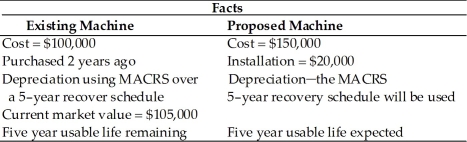

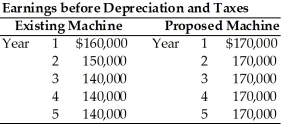

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

-Summarize the incremental after-tax cash flow (relevant cash flows) for years t = 0 through t = 5. (See Table 11.4)

Correct Answer:

Verified

Correct Answer:

Verified

Q63: The tax treatment regarding the sale of

Q64: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q65: The tax treatment regarding the sale of

Q66: The tax treatment regarding the sale of

Q67: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q69: A sunk cost is a cash flow

Q70: The tax treatment regarding the sale of

Q71: The relevant cash flows for a proposed

Q72: Should financing costs such as the returns

Q73: A corporation is considering expanding operations to