Essay

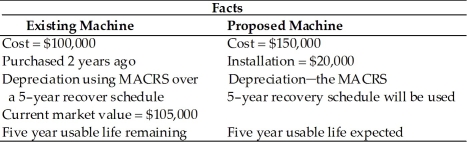

Table 11.4

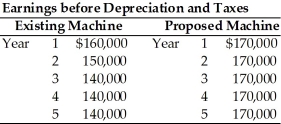

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given.

The firm pays 40 percent taxes on ordinary income and capital gains.

The firm pays 40 percent taxes on ordinary income and capital gains.

-Given the information in Table 11.4, compute the payback period.

Correct Answer:

Verified

PB = 3 + [($87,800 ...

PB = 3 + [($87,800 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Table 11.3<br>Cuda Marine Engines, Inc. must develop

Q100: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q101: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q102: Table 11.2<br>Computer Disk Duplicators, Inc. has been

Q103: Table 11.5<br>Nuff Folding Box Company, Inc. is

Q105: A corporation is selling an existing asset

Q106: An opportunity cost is a cash flow

Q107: Please explain the difference between a sunk

Q108: A corporation is considering expanding operations to

Q109: Table 11.4<br>Degnan Dance Company, Inc., a manufacturer