Multiple Choice

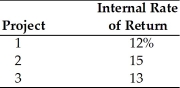

A firm with a cost of capital of 13 percent is evaluating three capital projects. The internal rates of return are as follows:  The firm should ________.

The firm should ________.

A) accept Project 1 and 2, and reject Project 3

B) accept Project 2, and reject Projects 1 and 3

C) accept Project 1, and reject Projects 2 and 3

D) accept Project 3, and reject Projects 1 and 2

Correct Answer:

Verified

Correct Answer:

Verified

Q157: If the NPV is less than the

Q158: Table 10.5<br>Galaxy Satellite Co. is attempting to

Q159: Economic value added is the difference between

Q160: A firm can accept a project with

Q161: What is the NPV for a project

Q163: Mutually exclusive projects are those whose cash

Q164: The payback period of a project that

Q165: The ranking approach involves the ranking of

Q166: Some firms use the payback period as

Q167: The NPV of a project with an