Multiple Choice

Table 10.3

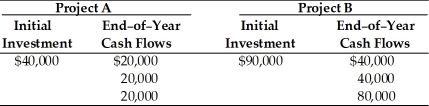

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-The new financial analyst does not like the payback approach (Table 10.3) and determines that the firm's required rate of return is 15 percent. Based on IRR, his recommendation would be to ________.

A) accept both the projects

B) accept Project A and reject Project B

C) reject Project A and accept Project B

D) reject both the projects

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Table 10.5<br>Galaxy Satellite Co. is attempting to

Q69: A $60,000 outlay for a new machine

Q70: What is the IRR for the following

Q71: The availability of funds for capital expenditures

Q72: On a purely theoretical basis, NPV is

Q74: _ is the process of evaluating and

Q75: What is the profitability index of a

Q76: One strength of payback period is that

Q77: The IRR method assumes the cash flows

Q78: Which of the following steps in the