Multiple Choice

Table 10.4

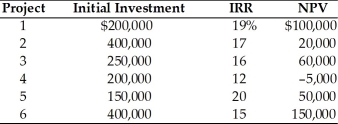

A firm must choose from six capital budgeting proposals outlined below. The firm is subject to capital rationing and has a capital budget of $1,000,000; the firm's cost of capital is 15 percent.

-Using the net present value approach to ranking projects, which projects should the firm accept? (See Table 10.4)

A) 1, 2, 3, 4, and 5

B) 1, 2, 3, 5, and 6

C) 2, 3, 4, and 5

D) 1, 3, 4, 5, and 6

Correct Answer:

Verified

Correct Answer:

Verified

Q139: A firm is evaluating two independent projects

Q140: A firm is evaluating an investment proposal

Q141: A project's net present value profile is

Q142: Table 10.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 10.2

Q143: If a firm is subject to capital

Q145: What is the NPV for a project

Q146: An internal rate of return greater than

Q147: A sophisticated capital budgeting technique that can

Q148: Should Tangshan Mining company accept a new

Q149: The financial decision makers find NPV more