Essay

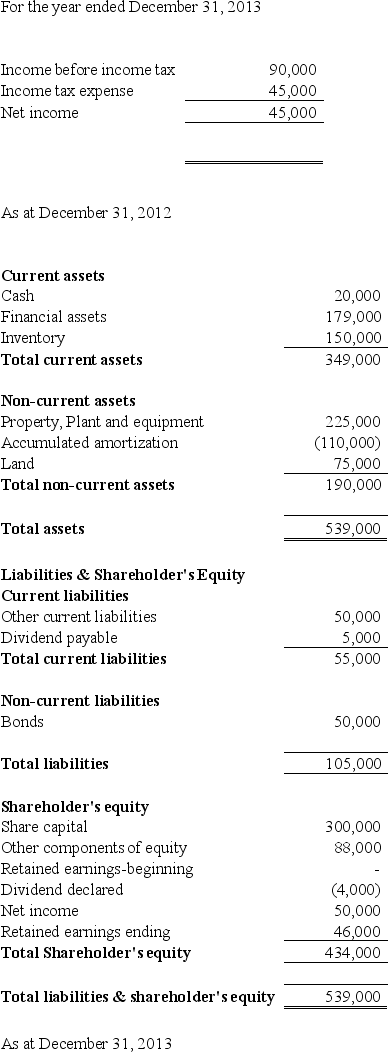

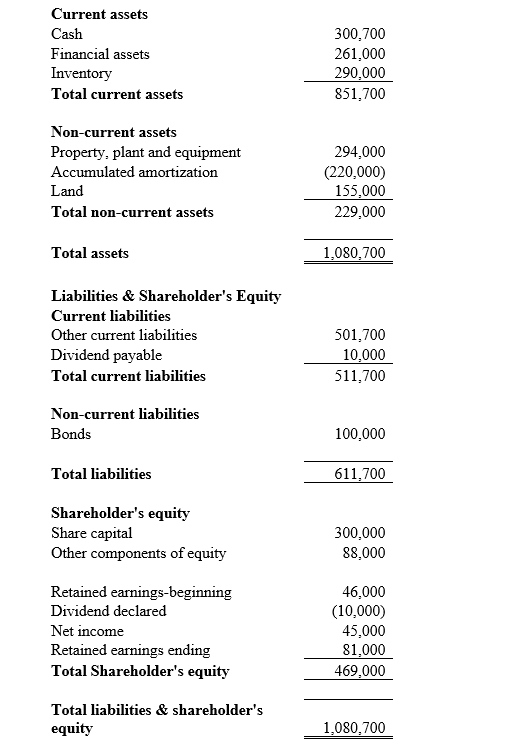

Mori Inc. is a company located in Canada and it uses the Canadian dollar as its functional currency. Mori Inc. began operations on January 1, 2012. Its shareholders are European. They would like the financial statements to be presented in Euros. The following is an excerpt from Mori Inc.'s financial statements for the 2012 and 2013 years. The changes in Other Comprehensive Income occurred evenly throughout the years. Dividends were declared at year-end.

The following exchange rates exist for the Euro relative to the Canadian dollar:

January 1, 2012 $1 Canadian = $1.40 Euro

December 31, 2012 $1 Canadian = $1.45 Euro

Average 2012 = $1 Canadian = $1.47 Euro

December 31, 2013 = $1 Canadian = $1.50 Euro

Average 2013 = $1 Canadian = $1.52 Euro

Required:

Translate the Mori Inc. financial statements as at December 31, 2013 from its functional currency to its presentation currency.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: What are the steps involved in the

Q23: Under IFRS, which of the following statements

Q24: A transaction gain or loss at the

Q25: Which of the following statements is TRUE?<br>A)The

Q26: Functional currency is the currency in which

Q28: Where is the ineffective portion of a

Q29: On June 1, 2013, Vandelay Co. entered

Q30: Companies sometimes purchase derivative financial instruments to

Q31: What exchange rate is usually used to

Q32: On June 1, 2013, Donlands Canada Co.