Essay

On January 1, 2011 Glass Inc. acquired 80% of the share capital of Crystal Ltd. For $400,000. At this date, the equity of Crystal consisted of:

Share capital: $200,000

Retained earnings: $75,000

At January 1, 2011 all of Crystal's identifiable assets and liabilities were recorded at fair value except for the following:

Equipment (cost ) Carrying amount: Fair value:

Land Carrying amount: Fair V alue: The equipment had a further useful life of 5 years. The land is still on hand. Glass uses the partial goodwill method.

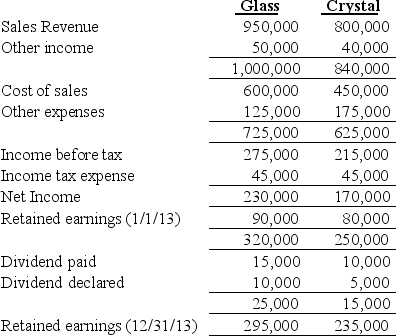

Financial information for the two companies at December 31, 2013 is as follows:

Additional information:

Additional information:

1. During 2012, Crystal sold some inventory to Glass for $10,000. This inventory had originally cost Crystal $4,000. At December 31, 2012, 20% of these remained unsold by Glass.

2. The ending inventory of 2013, of Glass, included inventory sold to it by Crystal at a profit of $4,000 before tax. This had cost Crystal $15,000.

3. The tax rate is 30%.

4. Glass's share capital has always been $100,000.

5. On January 1, 2014, Glass sold 10% of its ownership in Crystal so that it now owns 70%. They received $30,000 for the shares.

Required:

(a)Prepare the consolidated statement of comprehensive income and statement of changes in equity at December 31, 2013.

(b)Calculate the effect on consolidated equity in 2014 from the sale of the shares.

Correct Answer:

Verified

_TB3634_00

_TB3634_00  _TB3634_00

_TB3634_00  _TB3634_00 2) Non-...

_TB3634_00 2) Non-...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What are the characteristics for a transaction

Q25: Tamer Limited is a subsidiary of Wallen

Q26: A parent's consolidated net income which includes

Q27: Manuel Ltd. purchases 65% of Faiz Co.

Q28: Ownership interests in a subsidiary entity that

Q30: Kafka Ltd. purchased 80% of Littman Ltd.

Q31: Where does the non-controlling interest (NCI)appear on

Q32: The calculation of the NCI is necessary

Q33: Which of the following statements regarding the

Q34: When preparing consolidated financial statements, any profit