Essay

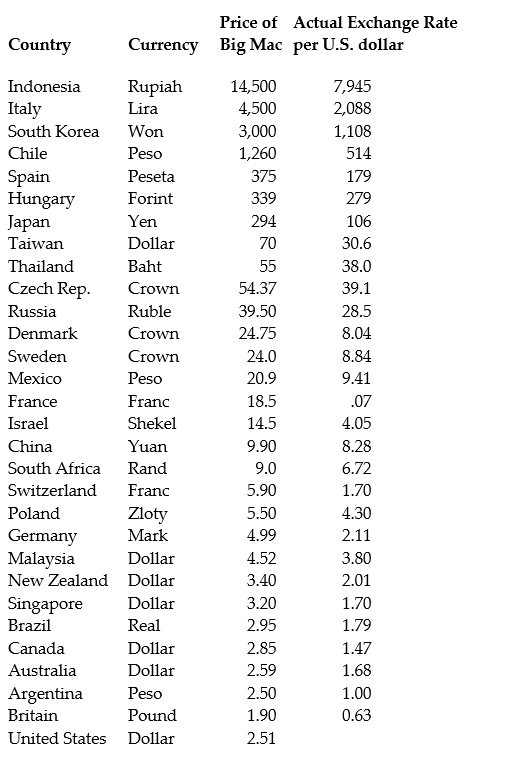

The news-magazine The Economist regularly publishes data on the so called Big Mac index and exchange rates between countries. The data for 30 countries from the April 29, 2000 issue is listed below:

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods … should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, 4th edition, Boston: Addison Wesley, 476)suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries.

(a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.). Calculate the predicted exchange rate per U.S. dollar by dividing the price of a Big Mac in local currency by the U.S. price of a Big Mac ($2.51).

(b)Run a regression of the actual exchange rate on the predicted exchange rate. If purchasing power parity held, what would you expect the slope and the intercept of the regression to be? Is the value of the slope and the intercept "far" from the values you would expect to hold under PPP?

(c)Plot the actual exchange rate against the predicted exchange rate. Include the 45 degree line in your graph. Which observations might cause the slope and the intercept to differ from zero and one?

Correct Answer:

Verified

(a)

(b)The estimated regression is as f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b)The estimated regression is as f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: You have learned in one of

Q46: You have obtained a sub-sample of

Q47: The help function for a commonly

Q48: At the Stock and Watson (http://www.pearsonhighered.com/stock_watson)website, go

Q49: The OLS residuals, <span class="ql-formula"

Q51: Consider the sample regression function<br>Y<sub>i</sub> =

Q52: The OLS slope estimator is not defined

Q53: The regression R<sup>2</sup> is a measure of<br>A)whether

Q54: The baseball team nearest to your

Q55: The OLS residuals, <span class="ql-formula"