Short Answer

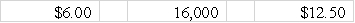

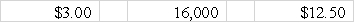

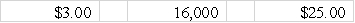

Helena Corporation declared a 2-for-1 stock split on 8,000 shares of $6 par value common stock.If the market price of the stock had been $25 a share before the split,the par value,number of shares,and approximate market value after the split would be:

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Van Buren Corporation issued 5,000 shares of

Q26: The class or type of stock that

Q137: Explain the differences in recording the initial

Q138: Prepare the journal entries needed for the

Q139: Vortex Corp.has 250,000 shares of common stock

Q140: Indicate how each event affects the elements

Q143: In accordance with restrictive debt covenants,Maynard Company

Q144: Green Corporation has the following stock outstanding:<br>In

Q145: On June 10,2016,Burton Builders,Inc. ,a publicly traded

Q146: The term "double taxation" refers to which