Essay

A sole proprietorship was established on January 1,2016,when it received $30,000 cash from Connor Howard,the owner.During 2016,the business earned $80,000 in cash revenues and paid $62,000 in cash expenses.Howard withdrew $9,000 from the business during 2016.

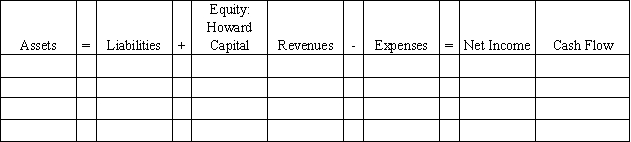

Required: Indicate how each of the transactions and events for the Howard sole proprietorship affects the financial statements model,below.Indicate dollar amounts of increases and decreases.For cash flows,indicate whether each is an operating activity (OA),investing activity (IA),or financing activity (FA).Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Establishing a sole proprietorship generally requires the

Q111: At the end of the accounting period,Houston

Q112: In which section of the balance sheet

Q113: Use the following to answer questions<br>Gilligan Corporation

Q114: Indicate how each event affects the elements

Q115: Prepare journal entries for the following transactions.<br>a)Issued

Q117: Which of the following statements about types

Q118: Llewelyn Company purchased 1,000 shares of its

Q120: A separate capital account would be maintained

Q121: Discuss possible reasons why a corporation may