Short Answer

Use the following to answer questions

In December 2016,Lucas Corporation sold merchandise for $10,000 cash.Lucas estimated that $700 of warranty claims might be filed in regard to these sales.On February 12,2017,warranty work amounting to $550 was performed for one of the customers ($430 labor paid in cash and $120 from the materials inventory).

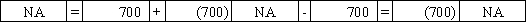

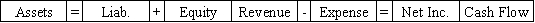

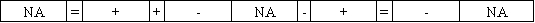

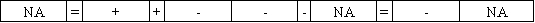

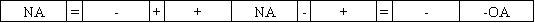

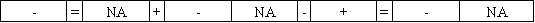

53.Which of the following answers correctly shows the effect of the recognition of the warranty obligation at the end of 2016 on the financial statements of Lucas?

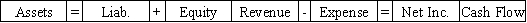

A.

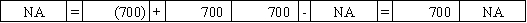

B.

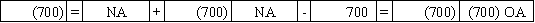

C.

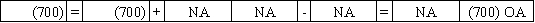

D.

Answer: D

Answer: D

Learning Objective: 09-04

Topic Area: Warranty obligations

AACSB: Analytical Thinking

AACSB: Knowledge Application

AICPA: FN Measurement

AICPA: BB Critical Thinking

Blooms: Analyze

Blooms: Apply

Level of Difficulty: 2 Medium

Feedback: The entry to estimate future warranty costs related to 2016 sales increases expenses (warranty expense),which decreases net income and equity,and increases liabilities (warranties payable).

-Which of the following reflects the effect of the year-end adjusting entry to record estimated warranty expense?

Correct Answer:

Verified

Correct Answer:

Verified

Q15: On a classified balance sheet,the financial statement

Q21: Craig Company experienced an accounting event that

Q23: Indicate how each event affects the elements

Q24: The amount of net income on the

Q25: Indicate how each event affects the elements

Q27: The December 31,2016 balance sheet of Rowan

Q29: Indicate whether each of the following statements

Q31: Indicate how each event affects the elements

Q73: FICA taxes are recorded both as salary

Q74: Under what condition should a pending lawsuit