Essay

On January 1,2016,the Dartmouth Corporation paid $18,000 for major improvements on a two-year-old manufacturing machine.Although the expenditure did not change the expected useful life,it greatly increased the productivity of the machine.Prior to this transaction,the machine account in the general ledger was listed at $84,000,and the accumulated depreciation account was $20,000.Dartmouth uses the straight-line depreciation method.The estimated useful life was six years,and the estimated salvage value was $4,000.

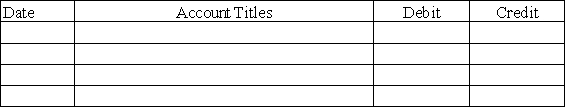

Required: a)Prepare the entry in general journal form for the January 1,2016 transaction.

b)Immediately after the January 1,2016 transaction,what is the book value of the asset on Dartmouth books?

c)Compute the depreciation for the machine for December 31,2016.

Correct Answer:

Verified

a)General journal entry for the January ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Expenditures that extend the useful life of

Q68: [The following information applies to the questions

Q82: The balance sheet of Flo's Restaurant showed

Q83: Indicate how each event affects the elements

Q84: Which of the following terms is used

Q85: Indicate how each event affects the elements

Q86: Describe what is meant by the term

Q88: In 2016,Hinkle Corporation Co.acquired a patent from

Q89: On January 1,2016,Stiller Company paid $800,000 to

Q90: Flagler Company purchased equipment that cost $90,000.The