Short Answer

Use the following to answer questions

On January 1,2016,Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500,respectively.During the year Kincaid reported $72,500 of credit sales.Kincaid wrote off $550 of receivables as uncollectible in 2016.Cash collections of receivables amounted to $74,550.Kincaid estimates that it will be unable to collect one percent (1%)of credit sales.

-Which of the following reflects the effect of the year-end adjusting entry to record estimated uncollectible accounts expense using the allowance method?

Correct Answer:

Verified

Correct Answer:

Verified

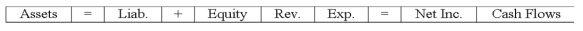

Q53: Indicate how each event affects the elements

Q54: Use the following to answer questions <br>The

Q55: When is uncollectible accounts expense recognized if

Q56: Indicate how each event affects the elements

Q57: Use the following to answer questions <br>The

Q59: Use the following to answer questions <br>On

Q60: The best estimate for the amount of

Q61: Why would cash sales companies,such as Wendy's,Domino's,and

Q62: Indicate whether each of the following statements

Q63: Indicate how each event affects the elements