Short Answer

Use the following to answer questions

On December 31,2015,the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible.Loudoun uses the allowance method of accounting for uncollectible accounts.In February 2016,one of Loudoun's customers failed to pay his $1,050 account and the account was written off.On April 4,2016,this customer paid Loudoun the $1,050.

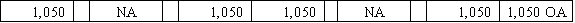

-Which of the following answers correctly states the effect of recording the collection of the reestablished receivable on April 4,2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Which one of the following is not

Q60: When a company receives payment from a

Q64: The following information is available for Plains

Q66: The operating cycle is the length of

Q67: Alberta Company accepts a credit card as

Q68: Indicate how each event affects the elements

Q71: Use the following to answer questions <br>On

Q72: The Griffin Corporation accepted a credit card

Q73: On June 1,2016,Carolina Company collected a $24,000

Q74: Indicate how each event affects the elements