Essay

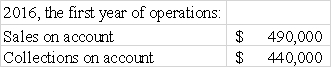

The following information is available for Phoenix Corporation,which uses the allowance method of accounting for uncollectible accounts.Phoenix expects 3% of sales on account to be uncollectible.

Required: a)Calculate the amount of uncollectible accounts expense for 2016.

b)Prepare the journal entry to record uncollectible accounts expense for 2016.

c)In 2017,after several attempts of collection,Phoenix wrote off accounts that could not be collected of $700.Prepare the journal entry to record the write-off of the $700.

d)Later in 2017,Phoenix received a check for $140 from one of the customers whose account had been written off in c),above.Prepare the required journal entries to record the collection of the $140.

Correct Answer:

Verified

a)$490,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Indicate whether each of the following statements

Q2: Indicate whether each of the following statements

Q3: What financial statement ratios facilitate the measurement

Q4: Use the following to answer questions <br>On

Q6: The amount of accounts receivable that is

Q7: A company that uses the direct write-off

Q9: The following information is taken from the

Q10: Indicate how each event affects the elements

Q11: Which of the following is not considered

Q39: The collection of an account receivable is