Essay

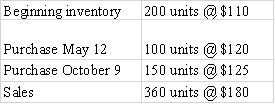

The following information is for Poole Company for 2016:

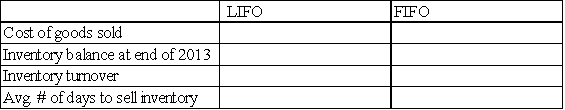

Required: a)Assuming that Poole uses the LIFO cost flow method,determine how much product cost would be allocated to Cost of Goods Sold,and how much to Merchandise Inventory at the end of the year.

b)Based on your results from part a,calculate inventory turnover and average number of days to sell inventory.

c)Assuming that Poole uses the FIFO cost flow method,determine how much product cost would be allocated to Cost of Goods sold,and how much to Merchandise Inventory at the end of the year.

d)Based on your results from part c,calculate inventory turnover and average number of days to sell inventory.

e)Compare your results from parts b and d.Do LIFO and FIFO give the same results for inventory turnover? Which is higher,and why?

Correct Answer:

Verified

a)- d)

e)LIFO and FIFO do not give the s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

e)LIFO and FIFO do not give the s...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: The Internal Revenue Service allows a company

Q121: Jones Company sells exercise bikes.Its beginning inventory

Q122: In relation to inventory,differentiate between the flow

Q123: Indicate whether each of the following statements

Q124: West Corporation's 2015 ending inventory was overstated

Q125: On February 2,2016,a fire destroyed the entire

Q127: Discuss the significance of the average number

Q128: Which of the following circumstances is not

Q129: Use the following information for questions <br>

Q131: If some inventory items have declined in