Essay

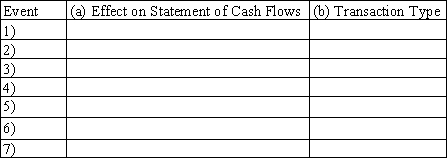

The following transactions apply to Kellogg Company.

1)Issued common stock for $20,000 cash

2)Provided services to customers for $38,000 on account

3)Purchased land for $15,000 cash

4)Incurred $29,000 of operating expenses on account

5)Collected $35,000 cash from customers for services provided in event #2

6)Paid $27,000 on accounts payable

7)Paid $2,000 dividends to stockholders

Required:

a)Identify the dollar amount effect on the Statement of Cash Flows,if any,for each of the above transactions.Precede a cash outflow amount with a minus sign.Enter NA for items not affected.

b)Indicate whether each transaction involves operating,investing,or financing activities.Enter NA for items not affected.

c)Classify the above accounting events into one of four types of transactions (asset source,asset use,asset exchange,claims exchange).

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The entry to recognize depreciation expense incurred

Q44: Two of the steps in the accounting

Q76: Recognition of revenue may be accompanied by

Q79: The term "recognition" means to report an

Q137: The Maryland Corporation was started on January

Q138: Which of the following describes the effects

Q139: Which of the following financial statement elements

Q140: Which of the following choices accurately reflects

Q145: Which of the following correctly states the

Q146: The recognition of an expense may be