Essay

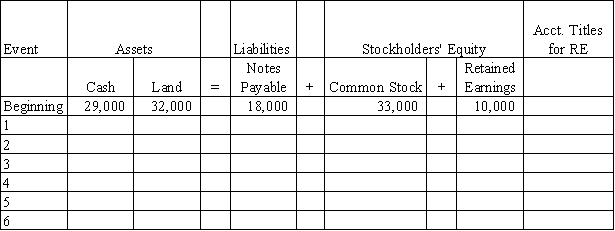

At the beginning of 2016,Grace Company's accounting records had the general ledger accounts and balances shown in the table below.During 2016,the following transactions occurred:

1.Received $95,000 cash for providing services to customers

2.Paid salaries expense,$50,000

3.Purchased land for $12,000 cash

4.Paid $4,000 on note payable

5.Paid operating expenses,$22,000

6.Paid cash dividend,$2,500

Required:

a)Record the transactions in the appropriate general ledger accounts.Record the amounts of revenue,expense,and dividends in the retained earnings column.Precede the amount with a minus sign if the transaction reduces that section of the equation.Enter 0 for items not affected.

Provide appropriate titles for these accounts in the last column of the table.

b)What is the amount of total assets as of December 31,2016?

c)What is the amount of total stockholders' equity as of December 31,2016?

Correct Answer:

Verified

a)

b)Total assets = $33,500 + ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b)Total assets = $33,500 + ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: If a corporation issues common stock for

Q25: What is meant by the term double-entry

Q26: Which of the following items would appear

Q27: Fill in the missing information by determining

Q29: Give three examples of asset use transactions.

Q30: Hazeltine Company issued common stock for $200,000

Q31: Which of the following accounts are permanent?<br>A)Retained

Q32: Expenses are shown on the<br>A)income statement.<br>B)balance sheet.<br>C)statement

Q33: Indicate how each event affects the elements

Q39: Turner Company reported assets of $20,000 (including