Multiple Choice

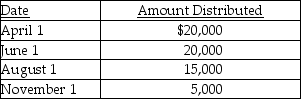

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend;$5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P,and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P,and $10,000 is tax-free as a return of capital.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Checkers Corporation has a single class of

Q5: John owns 70% of the May Corporation

Q5: Peach Corporation was formed four years ago.Its

Q8: Bart, a 50% owner of Atlas Corporation's

Q11: Which of the following statements best describes

Q16: When is E&P measured for purposes of

Q35: What is a stock redemption? What are

Q41: A partial liquidation of a corporation is

Q63: Which of the following statements is not

Q108: Ace Corporation has a single class of