Essay

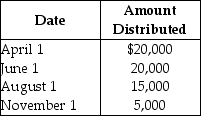

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Correct Answer:

Verified

The current E&P is allocated ratably to ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Which of the following is not a

Q40: Dixie Corporation distributes $31,000 to its sole

Q46: Bruce receives 20 stock rights in a

Q49: Identify which of the following statements is

Q50: Hogg Corporation distributes $30,000 to its sole

Q58: Identify which of the following statements is

Q74: Oreo Corporation has accumulated E&P of $8,000

Q93: When computing E&P, Section 179 property must

Q102: Susan owns 150 of the 200 outstanding

Q109: Boxer Corporation buys equipment in January of